Understanding your interest rate and how the interest is calculated is important if you want to tell a good deal from a bad one. One of the problems people often encounter involves the difficult calculations needed to work out compound interest rates and how does it affect your overall mortgage deal?

Compound vs. simple interest

Compound interest (sometimes referred to as ‘rolled up’ interest) is by far the most common form of interest on UK loans and mortgages. It is a fair system of interest calculation though more complicated mathematically.

Simple interest means the interest is calculated on the start value of the loan (called ‘the principle’) and never changes throughout the term of the loan.

Compound interest is recalculated as the loan is paid back, making it a more accurate reflection on the loan in current terms.

An example of simple interest

£1,000 loaned over 5 years with simple interest at 10% will incur £100 in interest each year, irrespective of how much has been paid off. By the end of the term, £1,500 will have been paid back in total – the principle £1,000 plus five years of £100 interest per year.

Simple interest is easy to calculate but over a long term will quickly result in far more interest being paid than a comparable compound rate.

Compound interest is recalculated as the loan goes along.

A simple example of compound interest

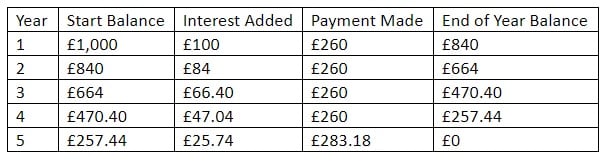

Again, take £1,000 loaned over five years, with 10% interest and £260 in payments being made each year (unlike the simple interest example, the payments are needed to illustrate how the compound interest works). The following table shows that balance at the end of each year and the interest that will be added:

After the final (slightly larger) payment is made to clear the remaining debt, the total that has been paid back is £1,323.18 – almost £200 less than the simple interest alternative. This is because as you pay back the capital of the loan you are making the balance smaller. As the interest is calculated on the balance and not the principle, each year less interest is added.

Compound interest and your mortgage

The small £1,000 loan version over five years given in our example showed a saving of almost £200 – close to 20% of the principle. The longer a loan goes on, the better an alternative compound interest is to simple interest; similarly, the larger the loan, the better compound interest is for the borrower.

And what’s the largest and longest loan you are ever likely to have? Your mortgage.

Crunching numbers – the true compound interest calculation

The simple example given above had the interest calculated annually, but in reality your mortgage interest is calculated monthly meaning every time you make a payment you lower the balance and thus the interest on the next month’s payment.

With compound interest and a repayment mortgage, the longer you get into the mortgage term, the more of the capital each month’s payment chips away. This has the joyous effect of helping you see the light at the end of the tunnel as you get closer to the end.

The maths behind compound interest can be overwhelming, but we live in a world of calculators and computers, so thankfully we don’t have to use a pen and paper ourselves. There are many online compound interest calculators out there to help you work out the exact numbers (if you want to!).

Overpayments – getting a bigger chisel to chip away!

If your mortgage deal allows for penalty-free overpayments then it’s great to take advantage of this if you get in some extra cash, such as from a bonus. Making an overpayment doesn’t just take that amount off your balance, it also lowers the amount of interest your mortgage will accrue for the rest of time!

Taking a chunk off your mortgage balance of a couple of thousand pounds every now and then can strip years off your mortgage term in the long run and is well worth doing if you can afford to.

Buy-to-let interest only mortgages and interest

A BTL mortgage is likely to be an interest only loan, meaning each month you only pay back the interest and never touch the capital. At the end of the term, the principle of the loan still needs to be paid back (but don’t worry, there’re plenty of ways to easily do that!).

Interest only mortgages have very low monthly costs, because you are not trying to chip away at the capital and only keep the interest from building. They do follow the rules of compound interest, however, and if you ever make a payment with the intention of lowering the capital balance, then the interest will drop accordingly.

When compound interest is bad for you

While slightly out of the scope of our specialisation here at The Mortgage Hut, an article on compound interest would be incomplete without a quick mention of loans running away with you. With your mortgage, you make regular repayments that keeps the interest paid and lowers the capital over time, but what if you have a loan where your monthly repayment doesn’t even cover the interest?

This can happen with some loans and means that the capital increases each month rather than decreasing. Then the interest in the following month is larger, the payment is not enough again and the capital increases further – this can spiral out of control very quickly with interest piling on interest relentlessly.

Our advice – never take out a loan if you can’t afford the repayments!

Discussing interest with The Mortgage Hut

Our advisors are experts in interest, so if you have any questions, just ask! Contact us today to find out how we can help you get the best low-interest deal on your mortgage – just fill out our contact form or give us a call!